Global Capital Markets

Equity Capital Market

SPDB International Global Capital Markets Department are renowned for their extensive network of relationships to see that the team impressive track record, issued underwriting business to cover various different levels...

More

Debt Capital Market

SPDB International has a well-established international platform for bonds syndication and distribution and is dedicated to providing full coverage of services for fixed income products, including product engineering, underwriting, and sales...

More

Equity Capital Market

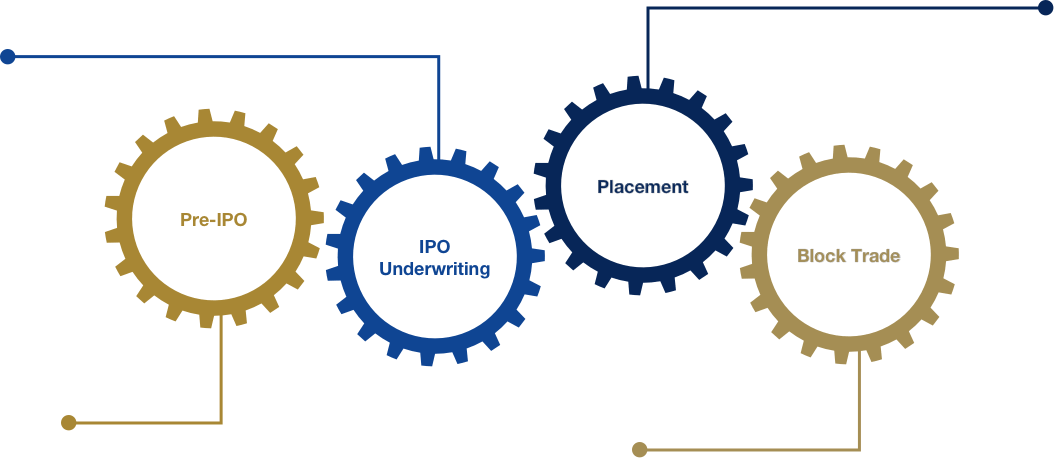

Equity Underwriting

-

Fundraising activities, such as placement of new shares and old shares,

organizing roadshows and etc

- Secondary markets Underwriter and Placing Agent

- Private Equity and Venture Capital

-

Acted as financial advisor to assist companies to

find private equity funds,

venture capital funds and strategic investors

- Secondary Market Block Trades

IPO underwriting

Placement

Track Record (projects which the team has taken part in)

Da Sen Holdings

HKD126 million

IPO

International Placing & Public Offer

Joint Lead Manager

2016.12

IPO

International Placing & Public Offer

Joint Lead Manager

2016.12

CSC Financial

HKD8.52 billion

IPO

International Placing & Public Offer

Joint Global Coordinator & Joint Bookrunner

2016.12

IPO

International Placing & Public Offer

Joint Global Coordinator & Joint Bookrunner

2016.12

China Industrial Securities Int’l

HKD1.33 billion

IPO

International Placing & Public Offer

Joint Bookrunner

2016.10

IPO

International Placing & Public Offer

Joint Bookrunner

2016.10